fanduel winnings tax rate|Taxes : Clark Let’s get into the specifics of Fanduel taxes for a clear understanding. Firstly, it’s important to know that Fanduel follows federal guidelines when it comes to winnings. .

On this page you'll find the most recent New Jersey Pick-3 Evening results for the last seven draws. The latest winning numbers are shown here within minutes of the draw taking place daily at approximately 10:57 PM EST. Pick-3 with FIREBALL is the jackpot game with two drawings every day and more $300 winners than all other NJ draw games combined!

fanduel winnings tax rate,We’re legally required to withhold federal taxes from sports wagering winning transactions as well as other qualifying casino game winning transactions when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at . Tingnan ang higit pa

The Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, . Tingnan ang higit pa

A Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit paFanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing . Tingnan ang higit paFanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit pa Let’s get into the specifics of Fanduel taxes for a clear understanding. Firstly, it’s important to know that Fanduel follows federal guidelines when it comes to winnings. .

Yes, FanDuel may periodically deduct taxes from your betting account. For instance, if you win $5,000 or more and the winnings are at least 300 times the wager, a .

A federal tax hit only comes into play if your gambling winnings reach $600 or more. Also, the rate at which you’re taxed varies based on how much you win.

If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting .

Taxes But whether you're wagering on the World Series from your couch or flying to Las Vegas for a weekend at the tables, you'll have to pay taxes on your winnings.

Fantasy sports winnings of $600 or more are reported to the IRS. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on .

Explore the intricacies of reporting FanDuel winnings on your tax return, from understanding tax withholding to tracking losses. Learn how to accurately report .Apr 05, 2022, 09:05 AM EDT. Download App. With two weeks left before the deadline to file your federal income taxes for 2022, Action Network's Sam McQuillan sat down with Richard Gartland, who's spent more .fanduel winnings tax ratemy understanding is that if you just put in $100 in your account. made thousands of bets many times over and winnings of $11,600 but your wagers were $11,000. despite only .

The undersigned certify that, as of June 13, 2023, the internet website of the California Department of Tax and Fee Administration is designed, developed, and maintained to be in compliance with California Government Code Sections 7405, 11135, and 11546.7 and the Content Accessibility Guidelines 2.1, Level AA success .Map of the world showing national-level sales tax / VAT rates as of October 2019. Additional local taxes may apply. [citation needed]A comparison of tax rates by countries is difficult and somewhat .

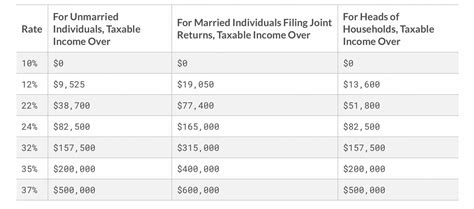

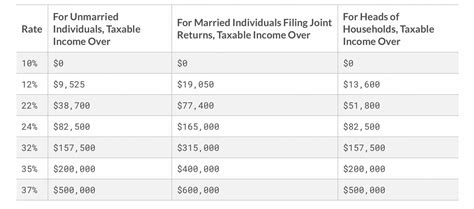

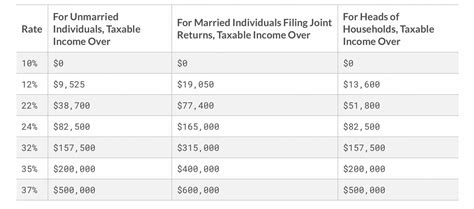

The federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing jointly. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). There are seven federal income tax rates in 2022: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable .

The rates have gone up over time, though the rate has been largely unchanged since 1992. Federal payroll tax rates for 2024 are: Social Security tax rate: 6.2% for the employee plus 6.2% for the . There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $693,750 for married couples filing jointly.fanduel winnings tax rate Taxes The new income tax rates from year 2023 onwards, as per the TRAIN law, are as follows. Taxable Income per Year. Income Tax Rate (Year 2023 onwards) P250,000 and below. 0%. Above P250,000 to P400,000. 15% of the excess over P250,000. Above P400,000 to P800,000. P22,500 + 20% of the excess over P400,000. On this page you will see Individuals’ tax table, as well as the Tax Rebates and Tax Thresholds – scroll down. To see tax rates from 2014/5, see the Archive – Tax Rates webpage. 2025 tax year (1 March 2024 – 28 February 2025) 21 February 2024 – No changes from last year. 2024 tax year (1 March 2023 – 29 February 2024)

fanduel winnings tax rate|Taxes

PH0 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH1 · Taxes on Sports Betting: How They Work, What’s

PH2 · Taxes

PH3 · Tax Considerations for Fantasy Sports Fans

PH4 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH5 · Sports Betting Taxes: How They Work, What's Taxable

PH6 · How to Pay Taxes on Sports Betting Winnings

PH7 · How much do your winnings get taxed? : r/fanduel

PH8 · How Much Taxes Do You Pay On Sports Betting?

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH10 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH11 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH12 · Effective Strategies to Handle Tax Withholding on FanDuel

PH13 · Are Fantasy Sports Winnings Taxable?